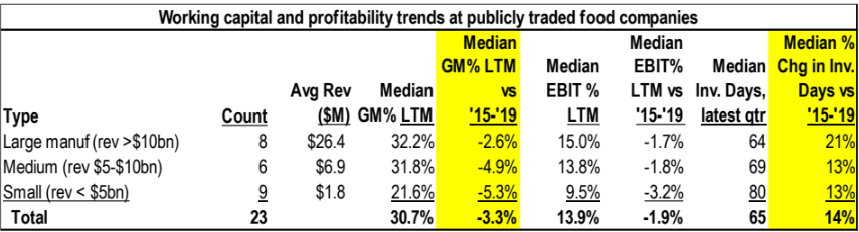

The average publicly traded food manufacturer holds ~15% more inventory today than pre-Covid (as measured by days on hand), while profitability has declined.

In the extremely low interest rate environment that persisted for much of the 2010s, the consequence of this trend would be relatively limited. No longer. The impact is particularly pronounced for middle market manufacturers (revenue < $750mn) served by food & beverage manufacturing specialists Saphineia Consulting Group, as these companies tend to operate with lower margins and higher inventory levels.

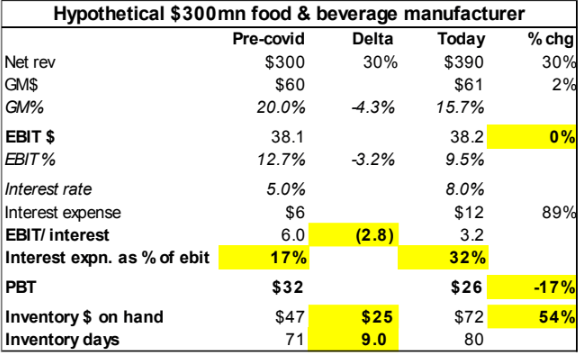

To illustrate, below we have estimated the financial impact of the combination of increased inventory and higher borrowing costs on a hypothetical middle market food manufacturer which, pre-COVID, had $300mn in annual revenue, 20% gross margins and 3x leverage. As shown below, even assuming strong pricing-driven revenue growth, tight SG&A control and flat operating income, this manufacturer’s pre-tax income would decline by 17% due to higher interest payments. At the same time, its working capital, debt, and leverage ratios would increase, reducing its financial flexibility.

Because inventory is a manufacturer’s largest operating cost and frequently one of its largest balance sheet items, the ROI of resources dedicated to tightly managing inventory levels and inventory losses (e.g. scrap, give-away, rework, run-out, and obsolete inventory) is significant. Yet most middle market food & beverage manufacturers struggle with inventory management.

Saphineia can help your business release cash tied up in working capital, reduce debt and improve profitability by:

- Right-sizing reorder mins & maxes to demand

- Ensuring supplier lead times are up-to-date

- Working with suppliers to reduce lead times and MOQs

- Assessing appropriateness of safety stock or floor stock requirements

- Reducing expired and obsolete inventory

- Minimizing losses associated with inventory run-out

- Reducing scrap, give-away, and the need for re-work