Do you TRULY understand your manufacturing costs?

Most middle market food & beverage manufacturers do not …and it’s costing them dearly

Determining the prices of one’s products and services is one of the most important activities undertaken by a business. Yet in our experience, most middle-market food & beverage manufacturers do not have a sufficient understanding of their unit costs. This leads them to misprice their products and make sub-optimal business decisions about which products, customers and channels to prioritize and how to allocate corporate resources.

Why do so many manufacturers struggle to understand their unit costs?

The short answer is that it is hard to do. Financial accounting isn’t designed to trace costs to SKUs and very few manufacturers have integrated their Chart of Accounts, financial reporting systems and production systems to do so. Further, business complexity is difficult to measure and quantify. Performing the detailed work of tracing costs to SKUs ‘outside of the system’ (and appropriately updating your standards) takes a significant amount of time and analytical resources, which many middle market manufacturers can’t readily spare. Not surprisingly, inertia typically wins out, with manufacturers continuing to ‘do it the way they’ve always done it’. Business owners and managers are left to make critical business decisions based on bad information.

What’s the big deal – how wrong can my model be?

This is no trivial accounting matter, nor an academic exercise. Most middle market food & beverage manufacturers rely on cost models that contain critical flaws and/or inappropriate simplifying assumptions, leading to poor pricing decisions, misperceptions regarding where they make and lose money, and suboptimal allocation of corporate resources. Once companies do this work, they frequently discover that a large portion of their SKUs do not contribute much to earnings or flat out lose money.

Common Costing and Financial Reporting Errors

In our experience, most manufacturers make one or more of the following costing errors:

- Not using standard cost accounting or, if they do, not regularly updating their standards

- Making overly optimistic assumptions regarding capacity utilization, production efficiency, scrap, crewing and hourly labor costs

- Not allocating costs for changeovers, allergens, unique ingredients/packaging, etc. to SKUs

- Using overly simplistic methodologies for allocating indirect costs

- Ignoring certain indirect costs all together (e.g. planned downtime, storage requirements – internal and external , freight, overtime, allergens, unique ingredients and packaging configurations, etc.)

- Ignoring the specific ‘costs to serve’ its customers (e.g. outbound freight, price discounts and deductions, R&D work, line time for trials, testing costs or mandatory pre-ship hold times)

Improving visibility into unit costs can be a huge value driver

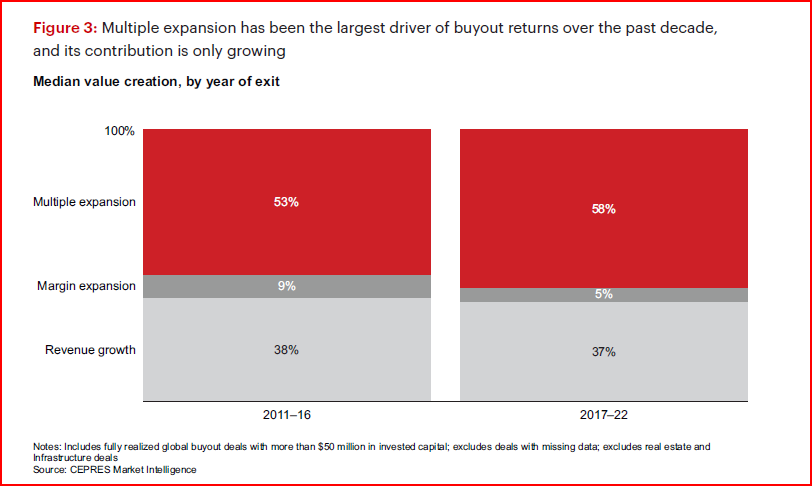

Historically, multiple expansion has driven the majority of buyout funds’ total investment return. Given the loose monetary policy from the Global Financial Crisis through 2022, and the tripling in the number of buyout funds over this same period, this isn’t surprising.

In today’s more difficult investment climate (ie, higher interest rates, there now are more PE firms than Hedge Funds), top quartile funds will be those that are able to help their portfolio companies increase margins.